So, one year has passed (or a little bit more) since the prodigal son (me) has returned home. Startup Wise Guys’ achievements we already highlighted somewhere else.

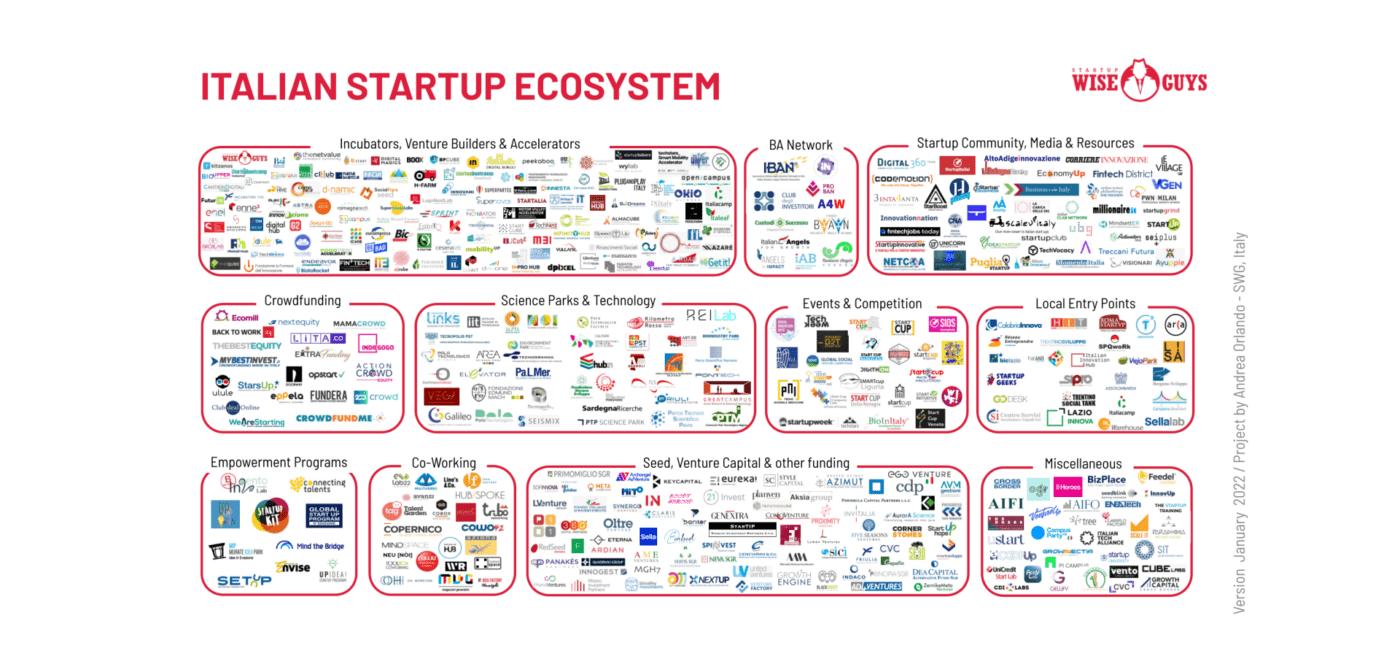

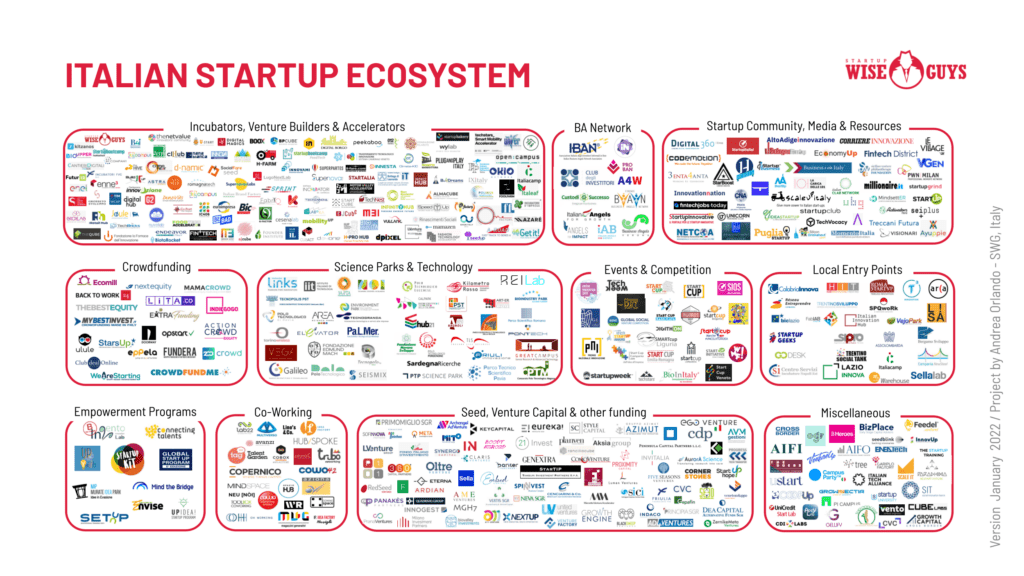

Now, with the new version of the Italian Ecosystem Map out and with the help of my merciless and futile sarcasm, it is time to focus a bit more on Italy. Yes, this is a controversial and beautiful country. Yes, this is a land full of hopes and opportunities but let’s face very often also full of crap (oops!). If I had to point out the reasons for the controversy it would be very difficult to be precise. First, I don’t have exact data on the matter and don’t want to indulge myself in speculation. Secondly, I am not in the business of pointing fingers. I don’t think it works.

If you’d like to see the Italian Ecosystem map in high resolution, please, [sg_popup id=”20908″ event=”click”]sign up[/sg_popup] for our Monthly newsletter.

What will work, I think, is to talk about both of the things that work and of the things that don’t work. So if you join me I will try and use my cheap content skills to bring you along with an imaginary journey where my beloved country is a multi-personality character. A hero and a villain, a two-faced character. One face is named “IT” and the other “ALY” (Did you get it? IT+ALY= ITALY? No? Didn’t think so!).

One face you really like and you would like to see more of. The other one – not so much, – and you could live with less.

So after 12 months more of “IT” that I would like to see for sure:

1. SEED investors:

Helping startups consolidate their PMF and reaching for Series A round. This is what this country needs, from a startup financial standpoint, the most. So all investors out there looking for an investment thesis. Don’t be shy. SEED deals are what you need.

2. Angel investors

Please, give me more Angel Investors who understand portfolio management, diversify risk through a series of investments, that invest more cash than services.

3. International VC’s

All International VCs are welcome here. Startup Wise Guys, Techstars, PlugandPlay are the first, but will not be the only ones.

4. Giving back

It is a good day when successful startuppers decide to re-invest time and resources in their own ecosystem. It is a sign of trust that startups are not a fashionable trend, that new role models are facing the scene hoping to inspire and create good.. It is a good day when Entrepreneurs decide to give back to the community…and I want to see more of those.

5. Diversity in teams

Diversity in teams opens up a whole new range of possibilities. It opens minds up.

6. INPS

INPS (Pension and retirement Italian agency) is an agency which I would have never thought I could speak well of. But I have to admit, it has been recently taken as a role model for its fantastic digital transformation journey. What does this have to do with startups and VC? Everything!

7. English speaking events

We need to make this country more attractive for international players. Let’s claim our role in Europe by acting truly European and accepting.

8. Constructive criticism

Constructive criticism is a current theme in my posts. Maybe because I lived abroad for so long, because a more mature ecosystem has happier, more satisfied people living in it, there is a tendency of avoiding back talking because that tends to unbalance the positivism built around. I think the day we will stop back talking about things we don’t know will be the day we can call ourselves part of a mature ecosystem.

9. South

I’m sentimental. I am from the South… There are some. But I would like to see more, many more. What do I have to do to see more entrepreneurs coming from south Italy? Investing in them? Done? Spending time in the south? Done Coaching teams from the south? Done. Come on guys and girls “ we come from a less developed area” does not work anymore in 2022. It’s time to rise.

And less of “ALY” will for sure help us growing

- Please, oh, please, let’s stop the 6 months due diligence process for a 500k€ round in startups. Teams need money now. If you haven’t made up your mind in 3 months, you never will.

- Why does a founder need to go physically in a bank branch to open a bank account in 2022? Non digital KYC should be over by now.

- Am I asking too much to stop belittling every time an entrepreneur sells their company for less than 100M. Yes, it’s not a Unicorn. But let’s celebrate regardless for crying out loud.

- LinkedIn profiles with not so credible one liners. Guys let’s face it, we know exactly what’s behind your one liner. Don’t tell us about your past. Tell us about your future and make it more interesting for everyone.

- Startup competitions with 3.000 EUR prizes. Let’s face it, if the startup is good they don’t need that kind of money, if the startup is not so good why did we have a competition in the first place if we weren’t able to attract the winning ones.

- It is so easy to build judgement over things we haven’t experienced directly. It’s a form of feeling safe. Psychology says that, Medicine says that, common sense says that. So what if we make a heartful decision for once to stop with prejudice and we embrace courage. It takes this little to create a better community, a better industry, a better ecosystem. Yes the ecosystem, if you have come at the end of this article you earned the right.

To see the Italian Ecosystem map in high resolution, please, [sg_popup id=”20908″ event=”click”]sign up[/sg_popup] for our Monthly newsletter.