Barely 6 million inhabitants, but already 6 startup unicorns – that’s the story of Baltics, this small region by the Baltic sea with tech-savvy people, who like to build, grow and sell their ideas. Estonia is also the birthplace of Startup Wise Guys, and currently, we have home offices in all 3 Baltic countries. Witnessing the grit and success of this region, 3 years ago we started something that has become a tradition – a comprehensive, data-driven overview of the Baltic startup ecosystem – Baltic Startup Scene report.

Even this year in the light of global pandemic was no different – region adapted fast to the remote work due to great network coverage and e-services, startup funding in H1 2020 went up compared to a year before, a positive wave of “hack the crisis” originated here and took over the World, and, based on opinions expressed in our Startup scene survey, both investors and startup representatives look positively ahead.

The Baltic Startup Scene Report 2019/2020 is out!

We are excited to share with you that the newest and largest-ever Baltic Startup Scene report is live! For the third year in a row, we are doing it together with our long-term partner EIT Digital to give you the most in-depth insight into the Baltic startup ecosystem, looking beyond pure data and zooming in on emerging trends, correlations, and real stories from founders and ecosystem players.

The report consists of 5 main sections – highlighting investment data within the Baltics, benchmarking Baltic results with its surrounding regions, ecosystem insights, a curated list of 150 startups to watch, and deep-dive analysis of what 2020 has been like for startups, investors, and the ecosystem and what is their outlook ahead.

What is special about this year’s report?

We found out that Baltic funding per capita is 5x larger than that of other Central and Eastern Europe (CEE) countries, H1 of 2020 was stronger than H1 of 2019 in terms of Baltic startup funding even despite the onset of a global pandemic and that startups are less negatively affected by the crisis in 2020 than other ecosystem players assume.

There were a lot of “firsts” with this year’s Report – first time we onboarded ecosystem partners – welcome, Accenture and UK Trade & Investment (DIT), first time got an impressive data set from Crunchbase to show you some cool insights on diversity and founders in the Baltics, first time showcasing so many, namely, 150 “startups to watch” and also the first time we launched our Startup scene survey – looking for real insights and stories (you’ll see a lot of references to this in the Report itself).

Let’s dive deeper into each Baltic country for some key insights:

Estonia

- Estonia dominates the Biggest deal list and also is a leader in the Baltics in terms of startup funding volumes, however, in terms of year over year change – has less growth than Lithuania.

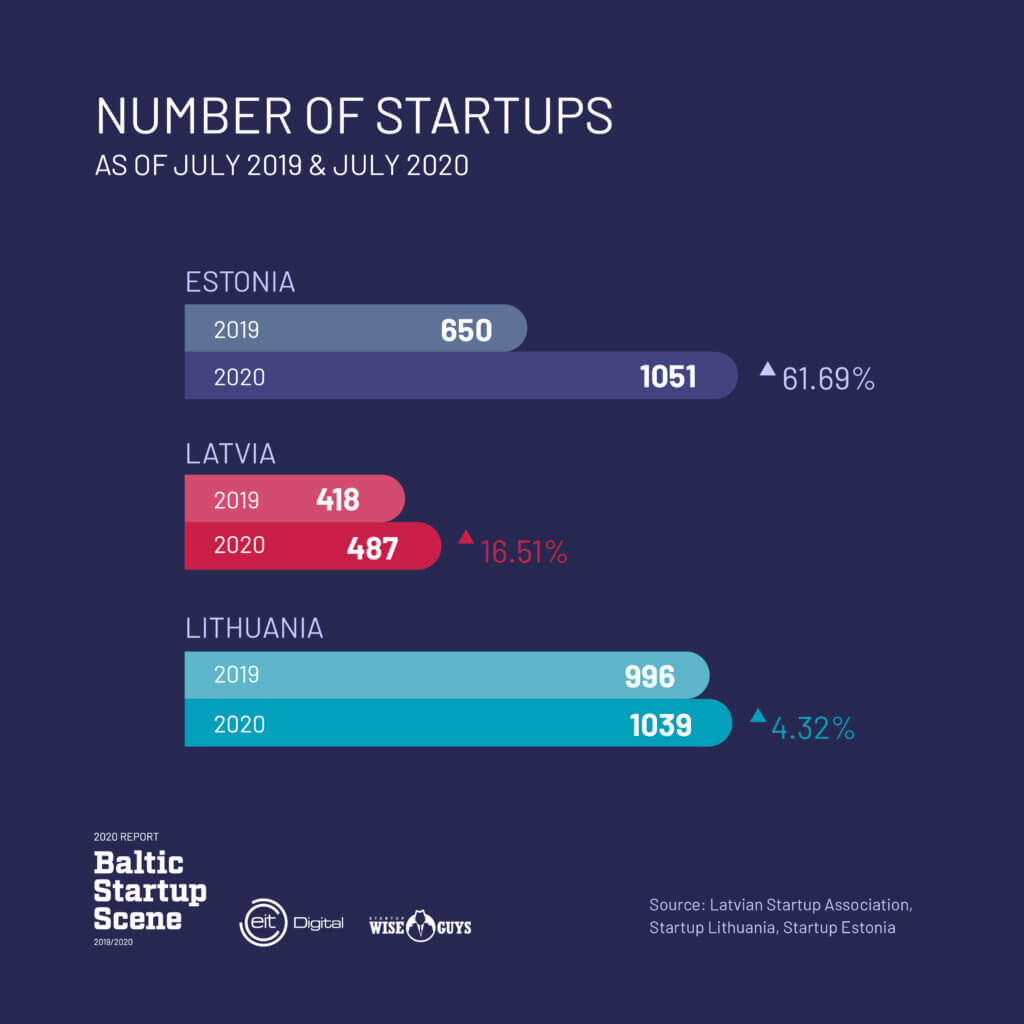

- The number of startups is up by 61.69% compared to 2019.

- Estonian startups dominate the Cybersecurity vertical in the “Startups to watch” list possibly due to strategic focus on this area by government and Startup Estonia, as well as 2 editions of Startup Wise Guys CyberNorth accelerator program.

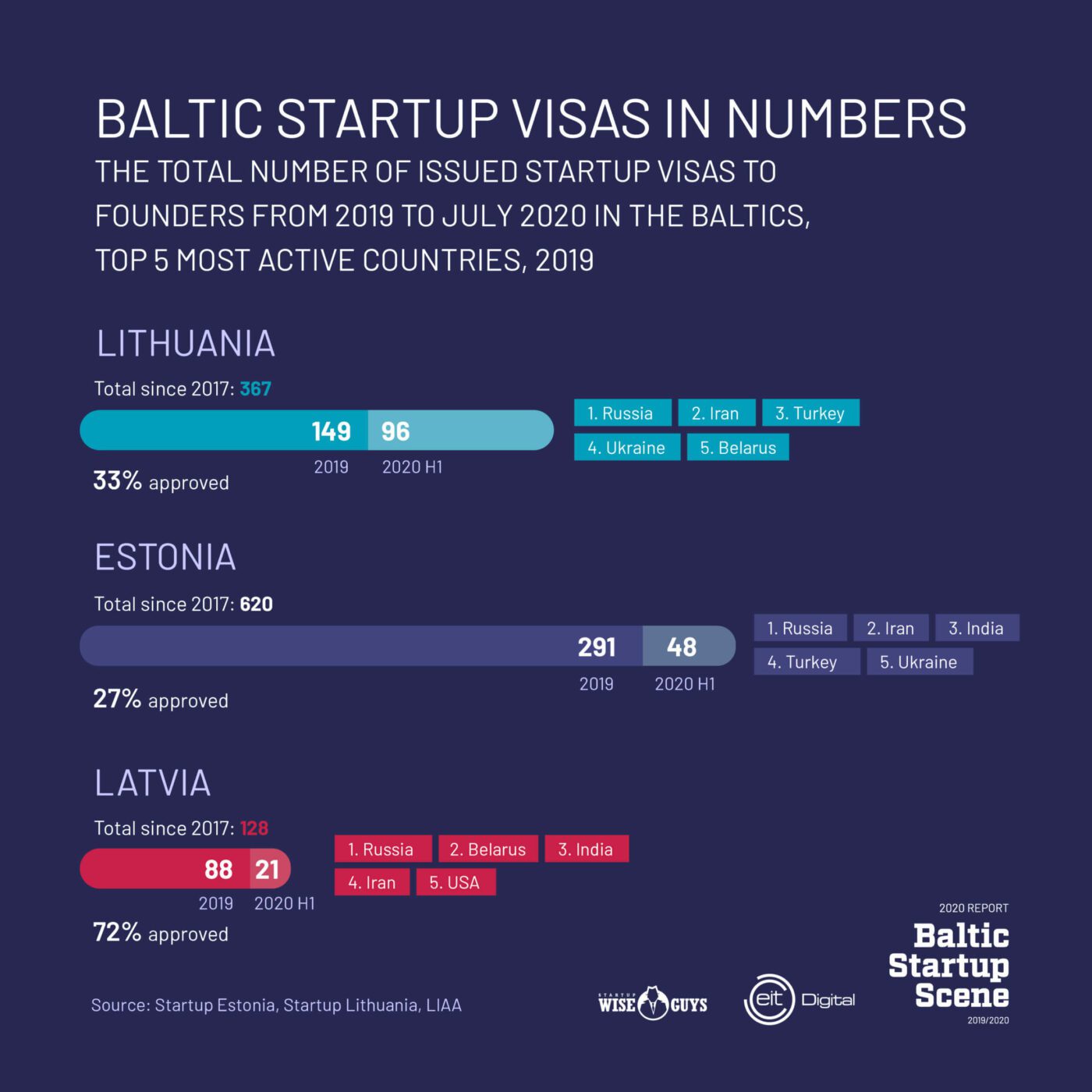

- Estonia has experienced the biggest drop among Baltic countries in terms of issued startup visas in 2020 compared to 2019.

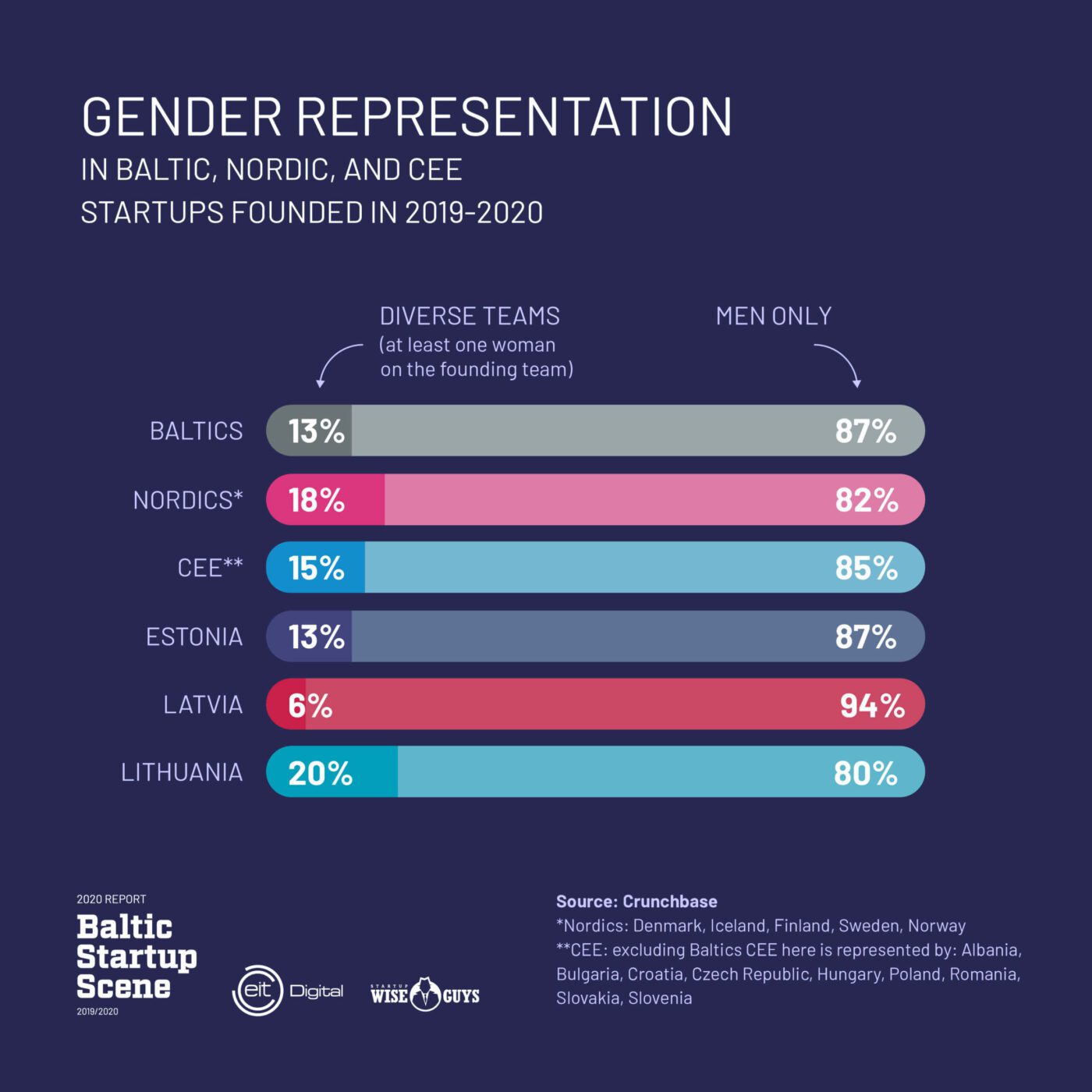

- While experiencing a slight drop in recent years, historically Estonia has the highest ratio of female founders in the Baltic states.

Latvia

- Latvia is experiencing a low period in terms of startup funding with most activity in the pre-seed stage in 2019/2020 which could be linked to accelerator fund and business angel activity.

- While being the smallest Business Angel Association in the Baltics in terms of members, LatBAN has the highest average deal per startup – 70K eur.

- Latvian startups are most represented in Hardware, Robotics, and IoT, as well as Sustainability and Medtech verticals in the “Startups to watch” list.

- Latvia has 9% of startups with at least 1 female founder, the lowest ratio in the Baltics

Lithuania

- Lithuania has maintained the best traction in terms of startup funding compared to the other 2 Baltic countries, H1 2020 vs H1 2019 grew by +128.48%.

- There is more female representation among Business angels and recently founded startups.

- Have significant representation among Fintech, SaaS, and Transportation verticals in Startups to watch list.

- Has had the most new startup visas issued in H1 2020 compared to Estonia and Latvia.

This year we also go deeper into the topics of diversity, hybrid work, and the outlook ahead. And all of this together with extra help from our ecosystem and content partners: Accenture Latvia,The UK Department for International Trade, Crunchbase, Change Ventures, Startup Estonia, Investment and Development Agency of Latvia (LIAA), and Startup Lithuania, as well as 70 experts and contributors!

And special thanks go out to the people without whom this report would not have happened: the content gurus from TrueSix, especially Julia Gifford, our amazing designer Liga Felta, partnership and project manager Goda Juskeviciute, and the core team dealing with content, marketing and data: Zane Bojare, Luize Sila and Marijus Andrijauskas.